defer capital gains tax canada

For example if you have a property worth 150000 and sell it for 200000 you can receive the amount yearly with over 50000 on profit. The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier.

Starlight Capital Tax Treatment Of Distributions

In our example you would have to include 1325 2650 x 50 in your income.

. Normally to defer the taxable capital gains into a QOF the profit must be reinvested into a QOF within 180 days of the sale date. In this way you only owe taxes on the received earnings. When you sell an investment property capital gains or losses are calculated by taking the difference between.

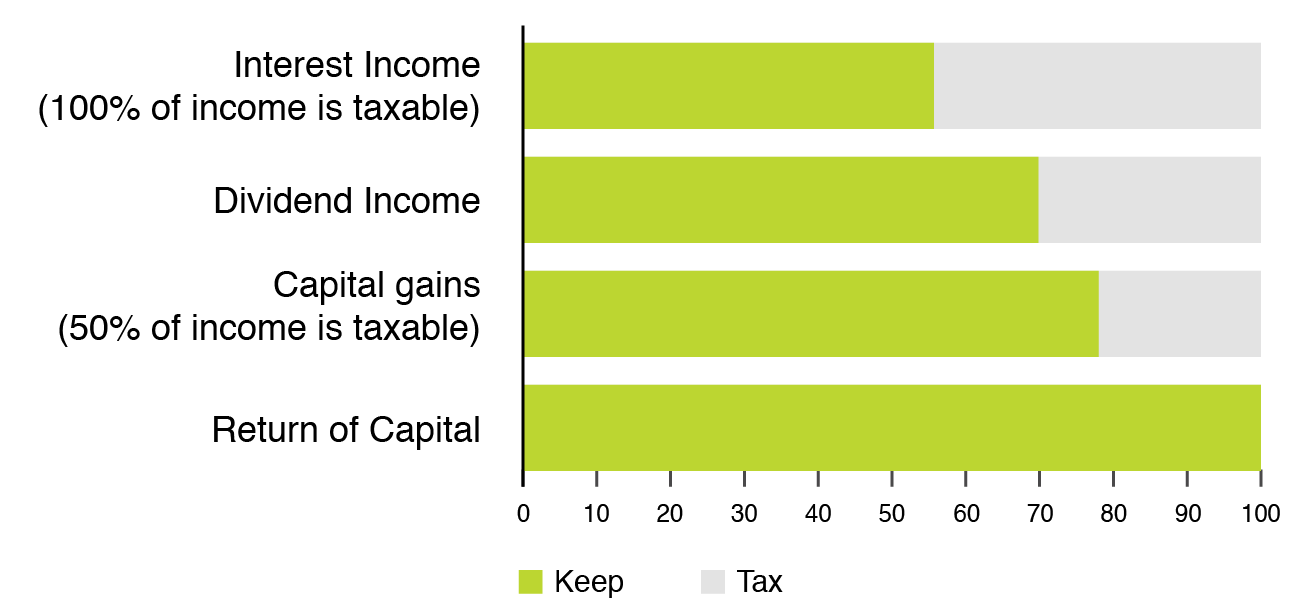

In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States. If you use all or more of the proceeds from selling the shares in your business to buy new qualifying investments you can defer 100 percent of your capital gains. In Canada you only pay tax on 50 of any capital gains you realize.

This can reduce your income tax significantly. In Canada 50 of the value of any capital gains is taxable. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free.

In the following year you would include the 225000 as a capital gain in your income and you would repeat the capital gains reserve calculation. For example lets say you purchased a painting for 10000 in 2013. The value of the deferral varies based on the percentage of proceeds you use to purchase the new investment.

For dispositions in 2021 report the total capital gain on lines 13199 and 13200 of Schedule 3 and the capital gains deferral on line 16100 of Schedule 3. Because of the COVID-19 pandemic the IRS has provided relief for the. So if your spouse bought 100 shares of ABC stock and then transferred them to you in the divorce neither of you will have to pay capital gains tax on it at that time.

This deferment strategy is known as the Capital Gains Reserve and there are a few rules to follow when you apply it. Can You Avoid Capital Gains Tax In Canada. 50 of the gain is taxed at your marginal tax rate.

Section 44 applies to a property that. Since its more than your ACB you have a capital gain. Canada does not have capital gains tax deferral rules like the US does 1031 exchange.

A capital gain of 75000 300000- 225000 in the year of the sale. In a nutshell you defer taxes then reduce then you eliminate them. Defer capital gains You can defer paying capital gains tax for your shares only when you got them from a spouse or parent due to death or divorce.

Together these transactions let the seller defer capital gains tax and net 935 in sales proceeds in cash. Claim a capital gains reserve If you sell an asset at a profit its possible to spread the capital gain over a period as long as five years if you defer collection of some of the sale proceeds. The artists reputation grew over the years and you then sold that painting for 20000 in 2021 realizing a capital gain of 10000.

Generally the capital gains reserve can. The sale price minus your ACB is the capital gain that youll need to pay tax on. No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale.

In Canada taxpayers may defer and roll capital gains into replacement properties under either section 44 or 441 of the Act. If your activity with respect to a property is in the nature of an investment as opposed to a business the gain on the sale of the property will be taxed as a capital gain ie. If you invest that 250000 gain in a QOF within the required 180-day period you can defer the gain and the tax on the sale.

Investment Period Extended To Defer Capital Gains. Capital gains deferral B x D E where B the total capital gain from the original sale E the proceeds of disposition D the lesser of E and the total cost of all replacement shares. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain.

I Has been stolen destroyed or expropriated often referred to as an involuntary dispositionor. It is possible to defer eligible capital gain tax if you invest in a qualified opportunity fund QOF by delaying the sale of your property. 31 the deferral applies so QOF investments can be purchased or exchanged.

In Canada 50 of your realized capital gains are included as part of your taxable income and taxed at your marginal tax rate. You can defer the remaining 225000 capital gain to future tax years. There are six ways to avoid capital gains tax in CanadaThe tax shelters serve as a place to keep money and to file taxesLosses in capital are offset by capital gainsIncrease capital gains over previously realized amountsThis tax exemption does not apply to life-long capital gainsYou can donate your shares to charity by purchasing themIn addition to capital.

Comments for Deferal of capital gains tax in Canada. One of the cleanest ways to save yourself from capital gains tax in Canada is to defer your earnings. Click here to add your own comments.

To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your selling price. In that way the tax will. A Tax-Deferred Cash Out combines an installment sale to a dealer who resells the asset to the end buyer for cash with a loan from a third-party lender.

Think of it as a tax deferred installment sale coupled with a tax-free loan. Regardless of what happens after 31 2026 we will announce the event soon. You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be able to cash out of the fund 100 tax free.

Your sale price 3950- your ACB 13002650. According to the long-term capital gains exemption you may avoid paying tax on the capital gains of small businesses if your share of the business is owned by a small business corporation and the property that qualifies as a fishing and farming property qualifies for the exemption. Ten-year reserve period for.

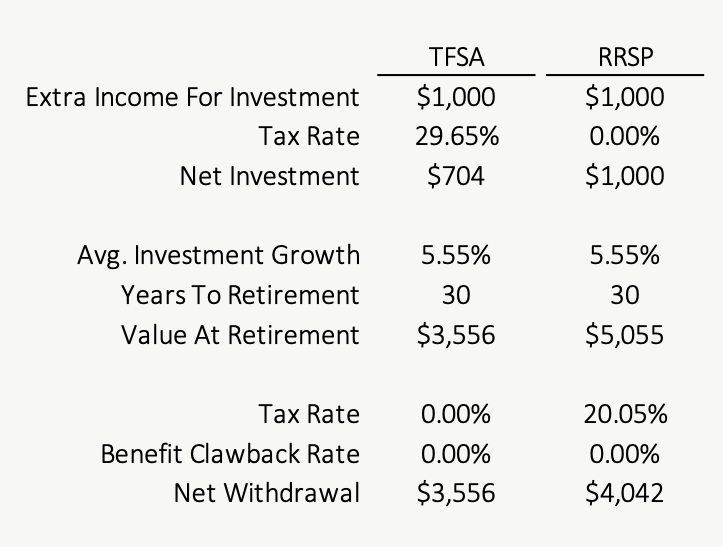

Tax Deferral Is Not Necessarily An Advantage Planeasy

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

How To Defer Capital Gains Tax On Real Estate Canada Ictsd Org

Basic Principles Of Deciding A Tax Jurisdicti Scarborough Tax Investing

Savings Hierarchy Savings Strategy Financial Planning Hierarchy

What Is Oas An Overview Of The Old Age Security Pension Pensions Retirement Advice Personal Finance Blogs

Vanguard Inflation Protected Securities Fund Investing Protect Security Reading

10 Types Of Jobs That Will Make You Most Welcome In Canada Moving To Canada Canada Make It Yourself

Complete Guide To Canada S Capital Gains Tax Zolo

Complete Guide To Canada S Capital Gains Tax Zolo

Capital Gains Tax Calculator Real Estate 1031 Exchange Real Estate Investing Rental Property Investment Property Capital Gains Tax

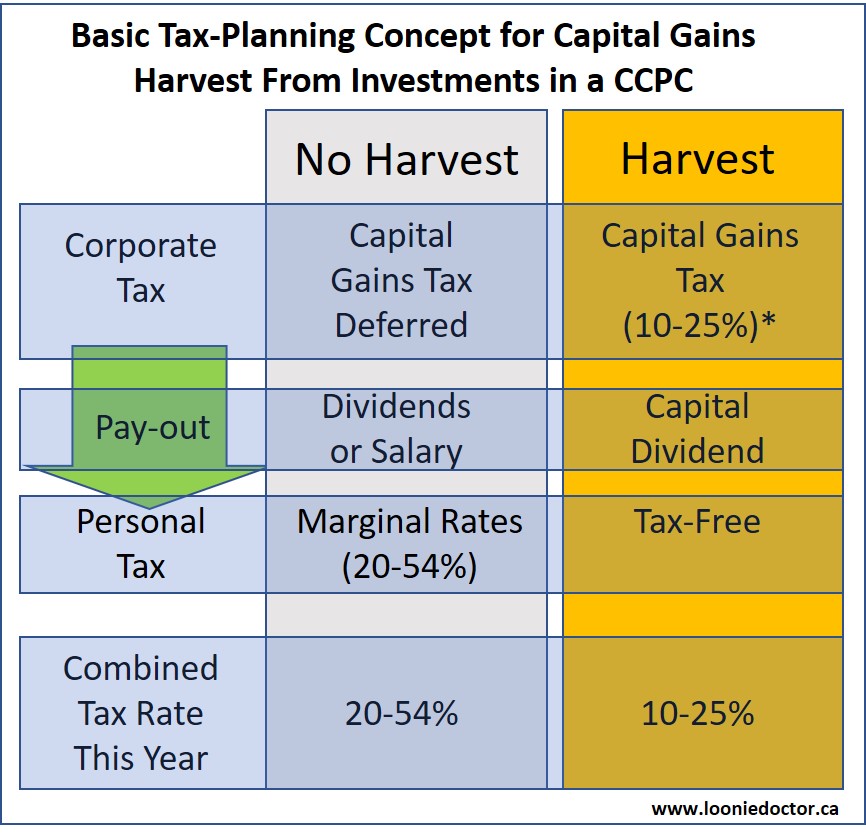

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Transferring Your Rrsp Tfsa Resp And Rrif Between Financial Institutions Financial Institutions Financial Canadian Money

Good Health Is Wealth Annuities As Well As Tax Obligation Annuity Tax Tax Money

What Is An Etf And Are Etfs A Good Investment Good Money Sense Money Sense Investing Investing Money

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Tax Tips 2016 Investment Income Capital Gains And Losses Tax Canada

How To Prepare Financially For A 6 12 Month Career Break Money Management Activities Fire Movement Career

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation